Donation Receipts Samples

There is no official template or format used but donation receipts commonly contain details of the donation including the donors name address and contact details as well as a list of items for non-monetary donation or amount of money donated. Charities are only required to submit 501c3 donation receipts for amounts greater than 250 but it is good practice to issue a 501c3 donation receipt for all donations.

Free Donation Receipt Templates Samples Word Pdf Eforms

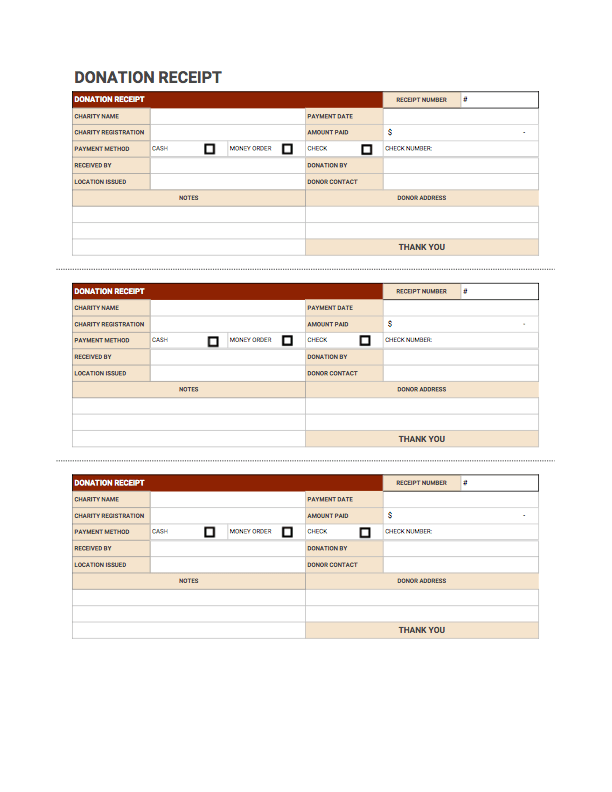

Donation and non-cash gifts receipt template.

. 501c3 Donation Receipt Template. Powerful Easy to Use. Download Donation Receipt Template 01 donation-receipt-template-01pdf Downloaded 92 times 95 KB.

In contrast In-Kind Donations encompass everything else from hard goods to real estate stocks and bonds. PdfFiller allows users to edit sign fill and share all type of documents online. Start for free today.

Free Donation Receipt Templates. Its a good idea to start your donation receipt templates with a generic email or letter that you can send for any donation or non-cash gift. WHAT is a donation receipt.

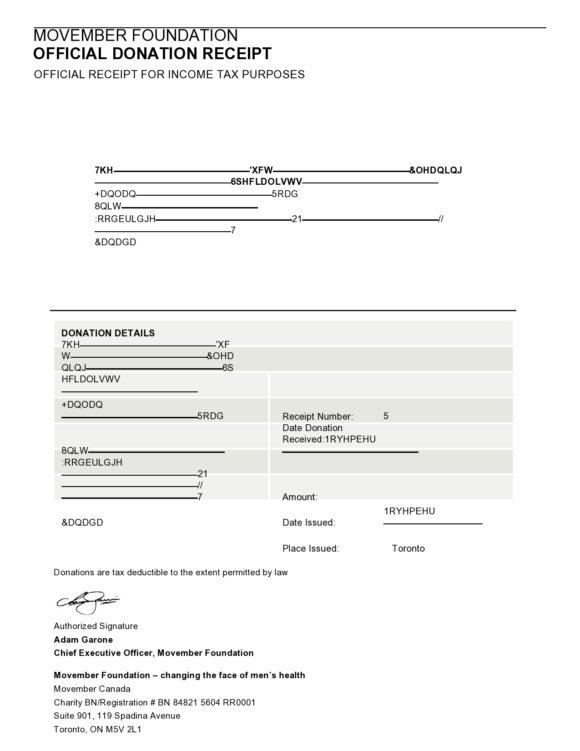

Here are previews and download links for these free Donation Receipt Templates. Ad Track Donors Issue Receipts More. 501 c 3 charity donation receipt is written by the charity organization upon receiving contributions worth 250 and above.

The IRS requires a donation receipt if the donation made is more than 250 regardless of whether the donation was in cash bank transfer or credit card. Sample 1 Cash gift no advantage. A donation receipt serves as a written acknowledgment that a donation was made to your group.

It is also a must part of this receipt. This shows that it is a donation receipt. Donations less than 250 do not need a 501c3 donation receipt to be deducted in tax.

Click to view a sample donation receipt. Donation receipts can be useful to both the donor and recipient. Its people like you who make what we do possible.

This word must be included at the top of this document. This is a letter thanking the person or the organization and at the same time acknowledging the person that you have received the needful. Donation receipt sample letter is the acknowledgment letter for receiving the amount of donation that you asked for either in the form of money or in kind.

Ad Purple Heart Tax Receipt More Fillable Forms Register and Subscribe Now. The receipt is important to the donor who gives out cash vehicle or personal property and wishes to have a tax deduction on the donation. It is quite necessary to have a Donation Contribution Receipt specimen according to the standards of IRS to save time.

Registered charities and other qualified donees can use these samples to prepare official donation receipts that meet the requirements of the Income Tax Act and its regulations. One can generate a unique serial number for donation receipts to make their accounting tasks easy. The word donation non-profit receipt.

It is a good practice to draft a letter acknowledging thankfulness for. An ideal donation script should include definite information about the amount of donation and what the donor received in return. Designing a specimen in advance and then using it to generate donation receipts every time is also a good and time saving practice.

Cash Donations come in the form of cash check or credit cards. Benefits of a Donation Receipt. Your donation of 250 on July 4 2019 to our Save the Turtles.

Download Donation Receipt Template 02 donation-receipt-template-02pdf Downloaded 107 times 38 KB. Professional look and organization for small businesses. A 501c3 donation receipt template is issued only by registered charitable organizations and allows users to claim tax benefits based on their donations.

The receipts do not have to be exactly as shown but they must contain the same information based on the following four types of gifts. It includes the organization logo name federal tax ID number and a statement that verifies that the organization is registered with. Ad Our site shows when receipts are sent viewed by your customer and accepted or declined.

Charitable donation receipts are imperative documents especially for charity institutions because donations are non-deductible for the donors. Format of a Non-Profit Receipt. The 501c3 donation receipt is customarily sufficient proof of a donors eligibility to the IRS.

You can make donation scripts digitally or use receipt templates available online which are printable too.

5 Donation Receipt Templates Free To Use For Any Charitable Gift Lovetoknow

Donation Receipt Free Downloadable Templates Invoice Simple

Donation Receipt Template Download Printable Pdf Templateroller

30 Non Profit Donation Receipt Templates Pdf Word Printabletemplates

Non Profit Donation Receipt Template Using The Donation Receipt Template And Its Uses Donation Receipt Templ Donation Letter Receipt Template Donation Form

Donation Receipt Template Pdf Templates Jotform

Donation Receipt Template For Excel

Comments

Post a Comment